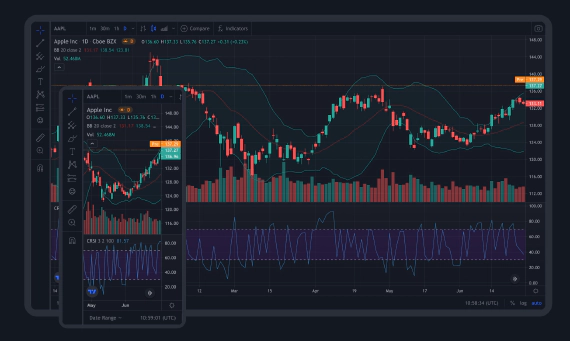

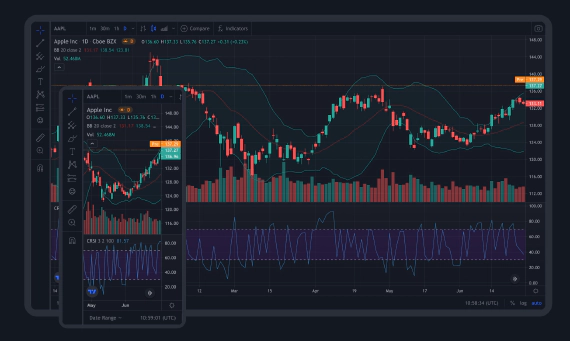

Trading view integration

At scalpers.sh uses trading view premium version as we believe they are true pioneer in financial charting system. …

Scalping is a popular trading strategy that aims to profit from small price changes in the financial markets. It is particularly prevalent in the derivatives market, where traders can leverage positions to maximize returns. This article delves into the intricacies of scalping derivatives, providing insights into the strategy, its benefits, and the risks involved.

Scalping is a trading technique that involves making dozens or even hundreds of trades in a single day, each aiming to profit from small price movements. Scalpers hold positions for a very short time, often just a few minutes or even seconds, and rely on the frequency of trades to accumulate profits.

Derivatives, such as futures and options, are financial instruments whose value is derived from the performance of underlying assets like stocks, commodities, or indices. The high leverage, liquidity, and volatility associated with derivatives make them ideal for scalping. Traders can take substantial positions with relatively small capital, magnifying both potential gains and losses.

Scalping requires quick decision-making and precise execution. Since trades are held for such a short period, any delay can turn a profitable trade into a losing one. Traders often use advanced trading platforms and algorithms to ensure they can enter and exit trades with minimal latency.

Scalpers rely heavily on technical analysis to make trading decisions. They use charts, technical indicators, and patterns to identify entry and exit points. Common indicators used in scalping include moving averages, Bollinger Bands, and the Relative Strength Index (RSI).

Effective risk management is crucial in scalping. Traders typically use stop-loss orders to limit potential losses and ensure they do not wipe out their capital in a few bad trades. Given the high leverage in derivatives trading, managing risk is even more critical.

Scalping is most effective in volatile markets where there are frequent price movements. Traders need to be aware of market conditions and news events that can cause sudden price swings. Economic data releases, earnings reports, and geopolitical events can all impact market volatility.

Momentum scalping involves trading in the direction of the current market trend. Traders look for strong price movements and try to capture the momentum by entering trades in the direction of the trend. This strategy relies on quick reactions to changing market conditions.

Range trading involves identifying support and resistance levels within which the price oscillates. Scalpers buy at support and sell at resistance, capitalizing on the predictable price movements within the range. This strategy works best in markets with low volatility and clear price channels.

Breakout scalping aims to profit from price movements that occur when the price breaks through a significant support or resistance level. Traders look for consolidation patterns, such as triangles or flags, and enter trades when the price breaks out of the pattern.

A robust trading platform is essential for scalping. Look for platforms that offer real-time data, fast execution speeds, and advanced charting tools. Examples include MetaTrader 4, NinjaTrader, and Thinkorswim.

Scalpers use a variety of technical indicators to analyze price movements. Moving averages, Bollinger Bands, and RSI are commonly used to identify trends, volatility, and overbought/oversold conditions.

Many scalpers use automated trading systems or algorithms to execute trades. These systems can analyze market data and execute trades faster than a human trader, reducing the impact of emotional decision-making and latency.

While scalping can be profitable, it is not without risks. The high leverage in derivatives trading means that losses can accumulate quickly. Additionally, the constant need for quick decision-making can be stressful and mentally exhausting. Scalpers also face significant transaction costs due to the high frequency of trades, which can eat into profits.

Scalping derivatives is a dynamic and challenging trading strategy that requires speed, precision, and a deep understanding of market dynamics. While it offers the potential for significant profits, it also comes with substantial risks. Successful scalpers combine technical analysis, risk management, and the right tools to navigate the fast-paced world of derivatives trading. As with any trading strategy, it is essential to practice and refine your approach to achieve consistent results.

At scalpers.sh uses trading view premium version as we believe they are true pioneer in financial charting system. …

youtube: https://youtu.be/k8d5p-Zwiyw?si=LiEDhHQxEuL_tmwc Get access to scalper.sh terminal in 2 minutes, by following …